In the world of debt recovery, the lines between who owns an account and who services it have started to blur. Yet, some companies like National Credit Adjusters (NCA) are choosing to make those lines sharper. The company has carved out its role not by spreading itself across multiple service models, but by focusing on recovering the debt it owns.

This ownership-first approach isn’t about managing someone else’s accounts but about taking full responsibility for the portfolios it acquires. The distinction brings a level of accountability and control, enabling NCA to tailor its strategies to the specific nuances of the portfolios it owns. This is especially important in complex segments like subprime lending, short-term installment loans, retail cards, and fintech-originated products, where borrower behavior and risk patterns require a more adaptive, hands-on approach.

For a long time, NCA kept its recovery efforts close to home, relying on its internal teams to manage operations from start to finish. That in-house model has been a strength, particularly when it comes to aligning compliance, strategy, and execution without a lot of external noise.

But as the recovery space is evolving, NCA is evolving with it. Legal partners and agency collaborators are selected carefully, with performance and oversight still anchored in NCA’s hands. It’s less about volume, more about building scalable recovery pathways without losing the rigor that comes from direct ownership.

This approach shapes the entire way NCA interacts with creditors. For lenders looking to divest distressed portfolios, the company offers a clean, structured way to transition those assets without adding complexity or risk. Once accounts are purchased, recovery is managed with the same principles that have guided NCA’s growth for years: data-driven decision-making, regulatory alignment, and performance accountability.

Whether collections happen internally or through trusted partners, creditors know their portfolios are being handled with strategy.

That reliability is especially critical now, as the debt landscape grows more fragmented and complex. The rise of fintech lending, BNPL models, and digital-first credit products has reshaped how and where delinquencies emerge. At the same time, regulatory scrutiny has intensified through measures like the CFPB’s Reg F and expanding state laws. In this environment, traditional single-channel or fully outsourced recovery methods are no longer enough.

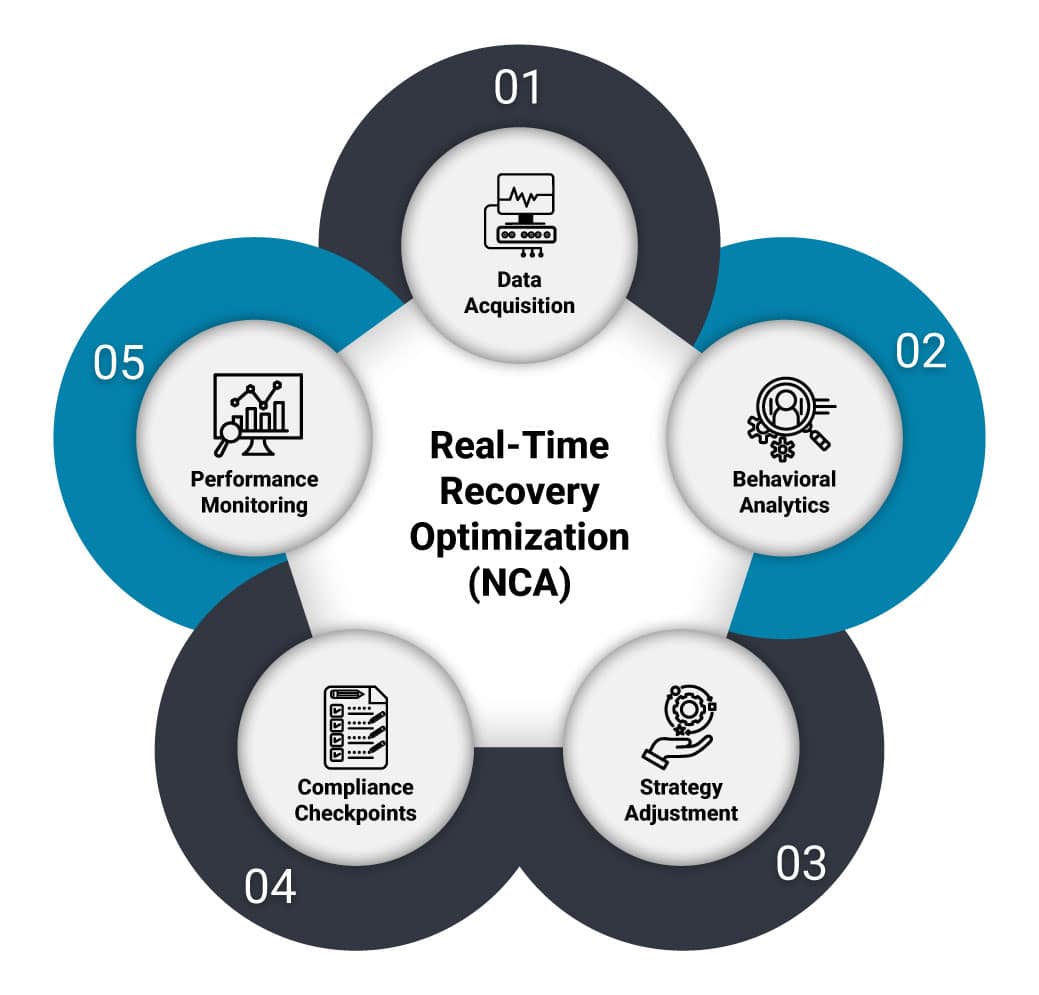

Creditors today seek recovery partners who understand the entire debt lifecycle and can deliver performance with precision. NCA meets this demand through its role as a debt buyer, using real-time analytics and adaptable outreach strategies to optimize results across the portfolios it owns.

Who Does NCA Collect For?

NCA purchases and manages debt portfolios from a range of creditors, including :

- Fintech Lenders and Alt-Fi Institutions

- Installment and Line-of-Credit Providers

- Retail Credit and Private Label Card Issuers

This wide spectrum of clients reflects a key trend that is outsourcing recovery not just as a cost-saving measure but as a strategic compliance buffer and performance optimization tactic.

What is a Debt Buyer? Rethinking the Term in a Modern Context

While “debt buyer” is often used to describe any entity purchasing receivables, the term has matured in its implications.

At a basic level, a debt buyer acquires accounts receivable, typically delinquent, charged-off, or non-performing at a discounted price, assuming the associated risk. But that description belies the complexity of today’s debt purchasing environment.

Characteristics of Modern Debt Buyers:

- Data Driven Approach – NCA’s acquisition strategies reflect a disciplined buy box and data-rich modeling, rather than opportunistic buying.

- Full Lifecycle Management – Buyers like NCA often control post-acquisition servicing, litigation strategy, and compliance oversight. They may hold direct recovery operations, contract with legal networks, or collection agencies.

- Compliance-first Posture – Especially post-CFPB enforcement waves and Reg F implementation, buyers must ensure their vendors are aligned on call frequency, dispute handling, and E-Oscar response quality. This makes vertically integrated buyers. Those with in-house servicing or tight controls, more attractive to sellers.

- Data Intelligence and Analytics – Debt buyers now operate more like data companies than collections shops. Sophisticated valuation models, behavior scoring, and recovery forecasting are embedded at acquisition and monitored throughout servicing.

The Appeal of Selling to a Buyer like NCA

For originators and creditors looking to offload distressed receivables, selling to an entity like NCA provides several benefits:

- Assured Compliance Chain – When the buyer is also a licensed servicer, creditors can be confident that account handling remains within regulatory guardrails. This is especially important for branded creditors concerned about reputation risk.

- Fewer Operational Hand-offs – Each layer of servicer handoff increases the risk of data loss, dispute mismanagement, or consumer confusion. Buyers who manage their own recovery minimize those risks.

- Specialized Recovery Across Verticals – NCA’s industry-specific experience (e.g., installment, fintech) allows for more accurate valuation and more efficient recovery — key factors in maximizing liquidation.

The Future of Debt Recovery

In a constantly changing industry filled with new regulations, evolving credit models, and shifting consumer behavior, staying ahead requires more than just experience. It calls for adaptability, smart use of data, and a strong commitment to doing things the right way. This is where National Credit Adjusters truly shines.

By combining disciplined portfolio acquisition with in-house and partner-led recovery execution, NCA offers more than the traditional approach to recovery. Its flexible, compliance-focused model is designed to support creditors through periods of uncertainty and growth alike. For those looking to offload portfolios or improve recovery without adding internal risk, NCA provides a clear strategic advantage.

If you’re ready to take a fresh look at how debt recovery can work for your business, NCA stands ready as a trusted and forward-thinking partner.

About National Credit Adjusters (NCA)

National Credit Adjusters, LLC specializes in purchasing and managing distressed and non-performing account receivables it owns. The company’s success is rooted in its core values of integrity, honesty, and transparency. With a strong focus on the customer experience over the last two decades, it has built trust and established long-term relationships that have enabled NCA’s continued progress and the success of its creditor clients.